Stock-Based Compensation in the SaaS World: Is it a Motivator or a Manipulator?

Why investors should exercise caution when a SaaS firms announces a profitable quarter!

Software-as-a-service (SaaS) has had a significant impact on the tech industry over the past decade, with thousands of companies emerging worldwide.

In the US alone, 75 of these companies have gone public and have a combined market value of over $1.1 trillion. Despite this impressive growth, SaaS represents only 10% of global IT spending, indicating a huge potential for further expansion. This potential is reflected in the impressive growth rates of many SaaS companies.

Source: Link

But something doesn’t add up here. Yes, the ongoing stock market correction has been painful for all sectors, but the beating taken by the SaaS companies is much more unbearable!

A closer look at the numbers reveals that while the broader S&P500 is down 21.1% in 1 year, the SaaS sector, as measured by the BVP Nasdaq Emerging Cloud ETF, is down 54.3%.

What is the stock market telling us?

Let’s zoom into the top 23 publicly listed SaaS companies with a $10Bn+ market cap (List of companies) to understand more.

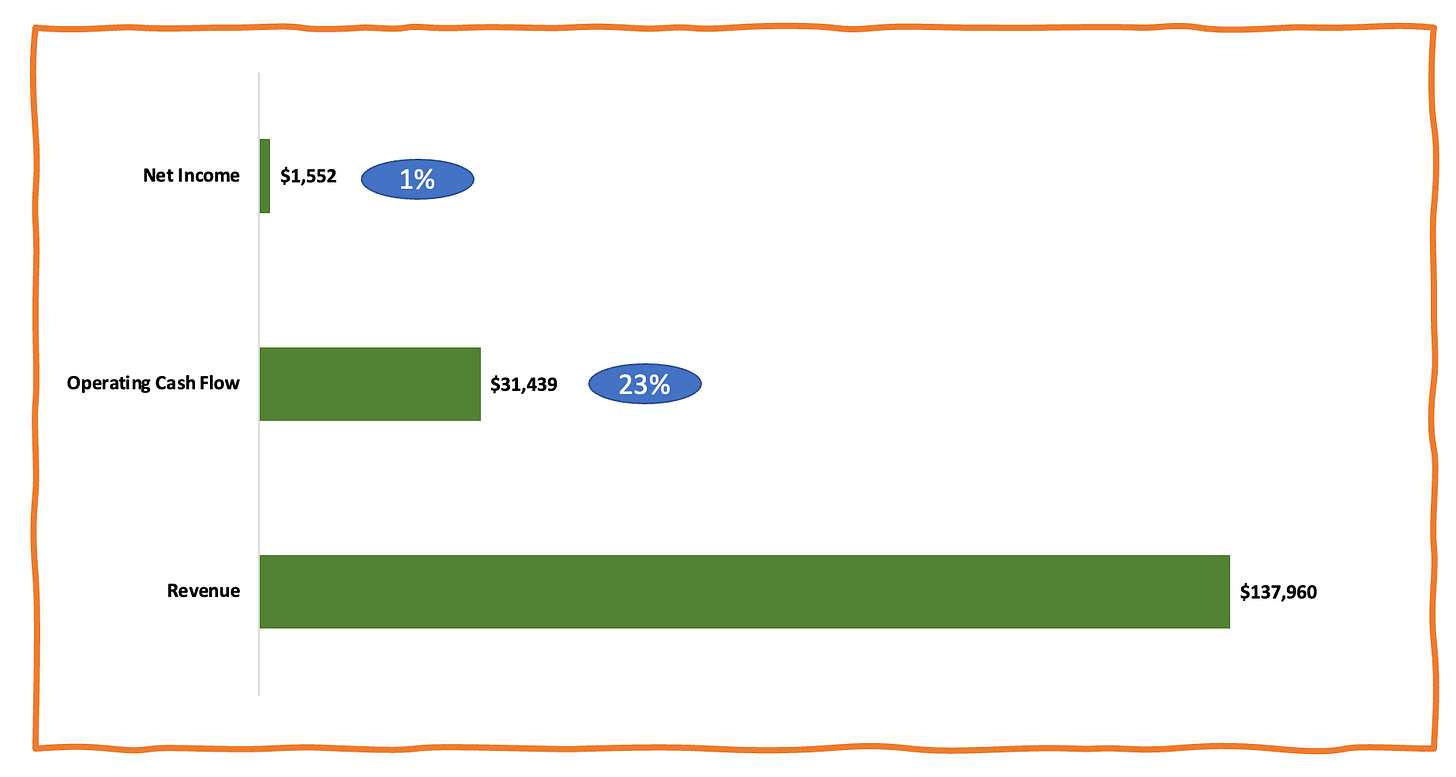

This group of 23 companies, with a combined market cap of $850Bn+, generated $135Bn+ revenue and $30Bn+ operating cash flow (OCF) in the last 12 months. In fact, 21 of these 23 companies reported positive OCF in the last 12 months while only 2 of them reported minimal losses. That’s phenomenal!

However, in the same group of 23 companies, 14 companies reported negative net income at their P&L level. In fact, the combined profits of these companies currently stand at just $1.5B, a mere 1.1% of the total revenue earned.

*Source: Quarterly company filings. Data reported for the last 4 reported quarters.

This dichotomy between 23% Operating Cash Flow to 1% Net Income (NI) is quite stark, and even more so for the asset-light SaaS companies, which don’t have depreciation expenses to bear with.

So, why is this happening?

The OCF reported by SaaS companies may not paint a complete picture of the firm’s profitability, as it gets influenced by stock-based compensation (SBC). This leads to a wide divergence between Operating cash flow (OCF) (23%) and Net Income (NI) (1%).

In simple terms, when a company pays part of an employee's salary in stocks, it artificially increases the cash flow, as the cash never leaves the bank. However, this expense gets accounted as part of the salary in the P&L statement. A higher than usual stock-based compensation (SBC) is a consistent trend among most SaaS firms.

Let’s see some numbers!

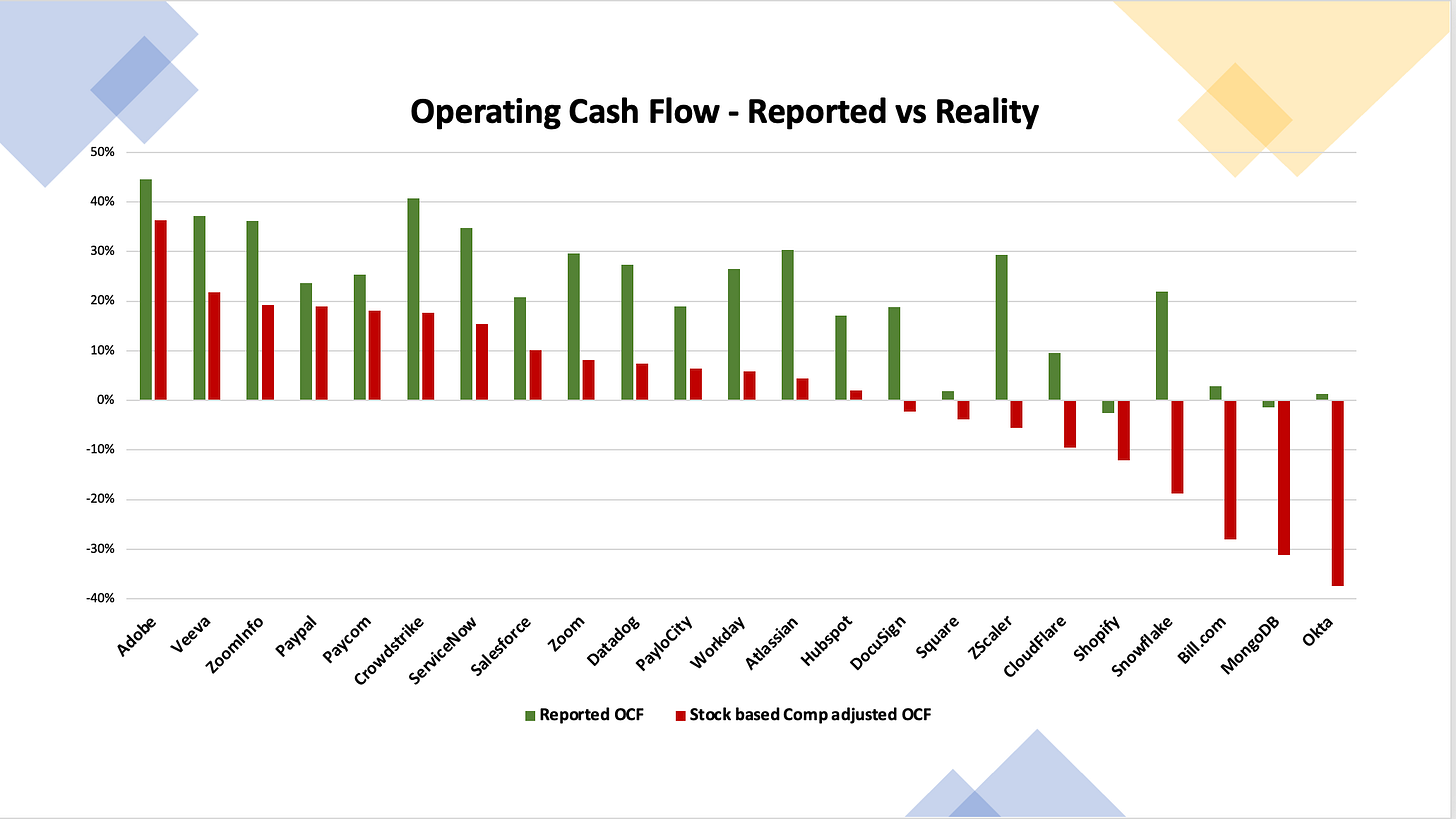

Below is a chart reflecting the company reported operating cash flows (OCF) vs the operating cash flows adjusted for stock based compensation (calculated as OCF- SBC). Immediately, one can notice that now 9 companies report OCF losses vs only 2 before. Even more so, firms like Crowdstrike, and ServiceNow, who reported a massive 35-40% OCF margins are down to the sub-20 % zone. Overall, the margin profile takes a beating across the board. In fact, the weighted average adjusted OCF margin for these 23 firms is 11% vs 23% reported - a sizeable drop of 12%. Wow!

*Source: Quarterly company filings. Data reported for the last 4 reported quarters.

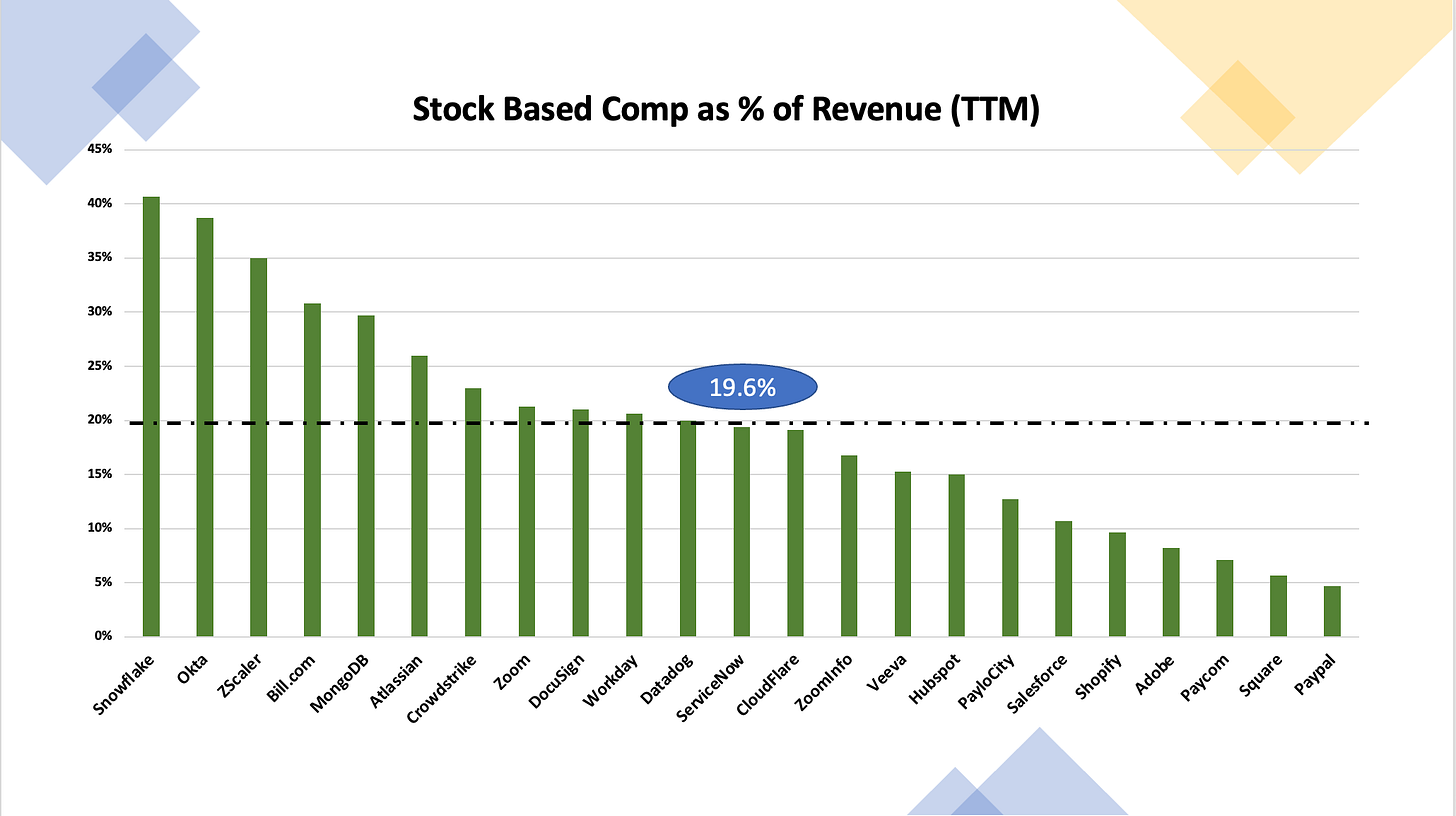

Overall, these 23 top SaaS firms are on average paying 19.6% of revenue in stock-based compensation. However, there’s some divergence here. On one end of the spectrum, companies like Snowflake, Okta pay a massive 35%+ revenue as SBC while on the other hand of the spectrum, Square and Paypal pay under 5% revenue as SBC to its employees.

*Source: Quarterly company filings. Data reported for the last 4 reported quarters.

(Side note - Square numbers are artificially low here as it has a big component of Bitcoin led revenue in its P&L)

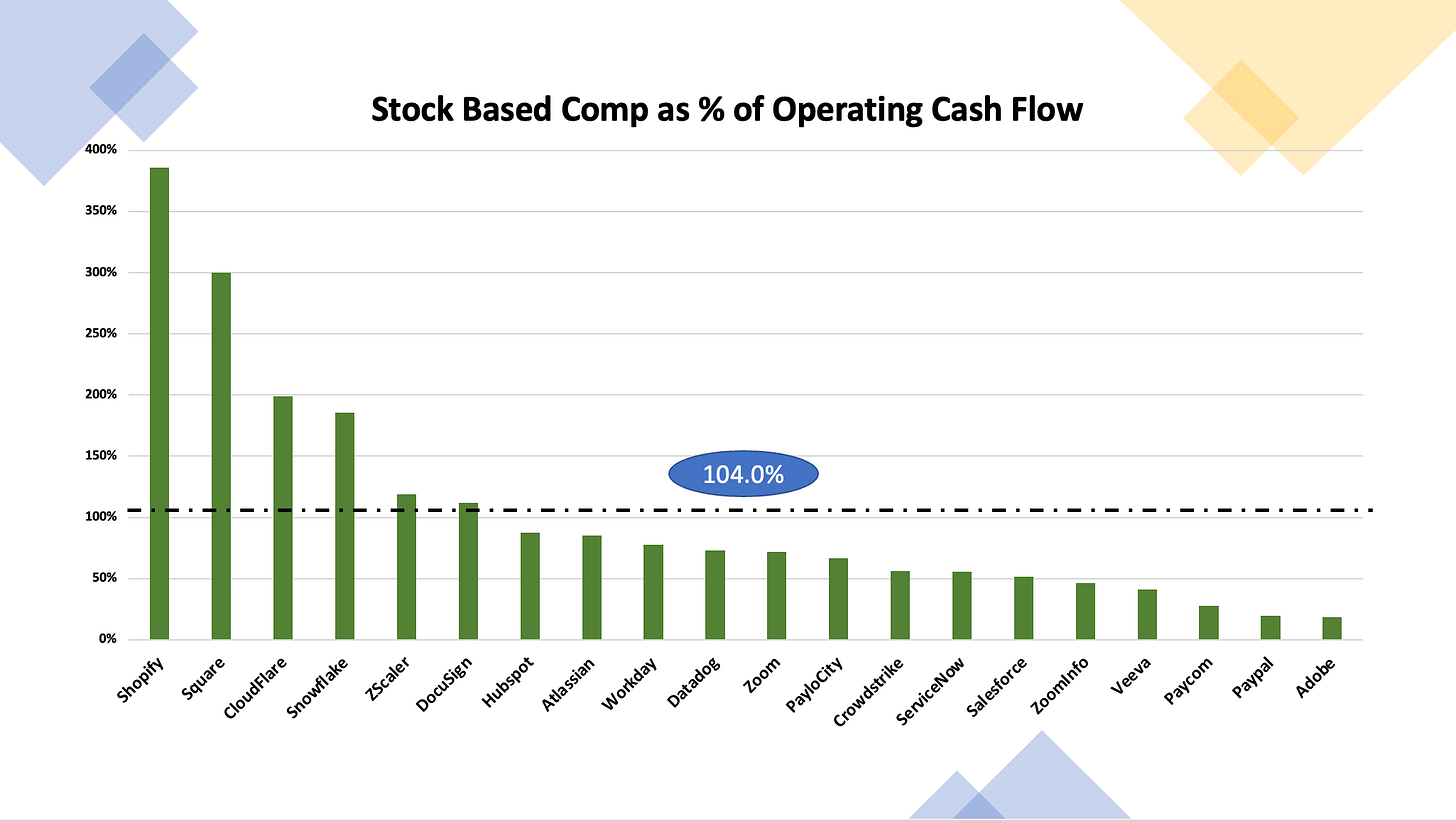

To add insult to the injury, stock-based compensation is more than 100% of the reported OCF - effectively eroding all the money they reportedly made for most of these companies.

*Data reported for the last 4 reported quarters.

How is the SBC share evolving with time?

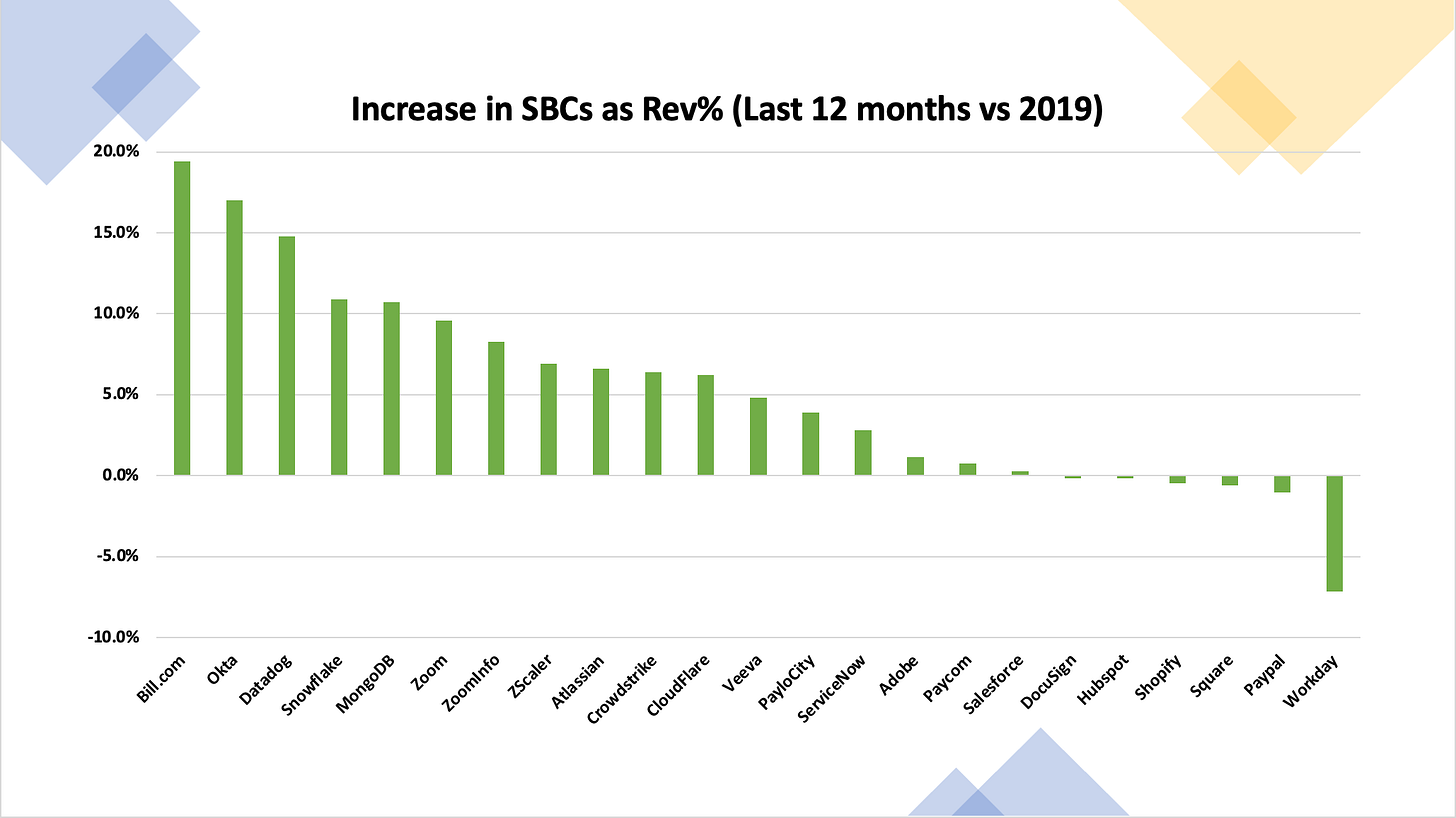

It’s actually increasing!

These 23 firms paid 10.8% of revenue in the year preceding covid vs 12% in the last 12 months - that’s 1.8% of revenue on a higher revenue base being paid as SBCs. In absolute dollar terms, these 23 companies rolled out US$16.5B in stock based comps in the last 12-months vs US$ 6.9B in 2019 (pre-covid) - an increase of US $9.5Bn in just 2.5-3 years.

Specifically, 16 of the 23 SaaS companies paid more SBC as a share of their revenue in the last 12-months than they did in 2019, 4 of these increased SBC by more than 10%!

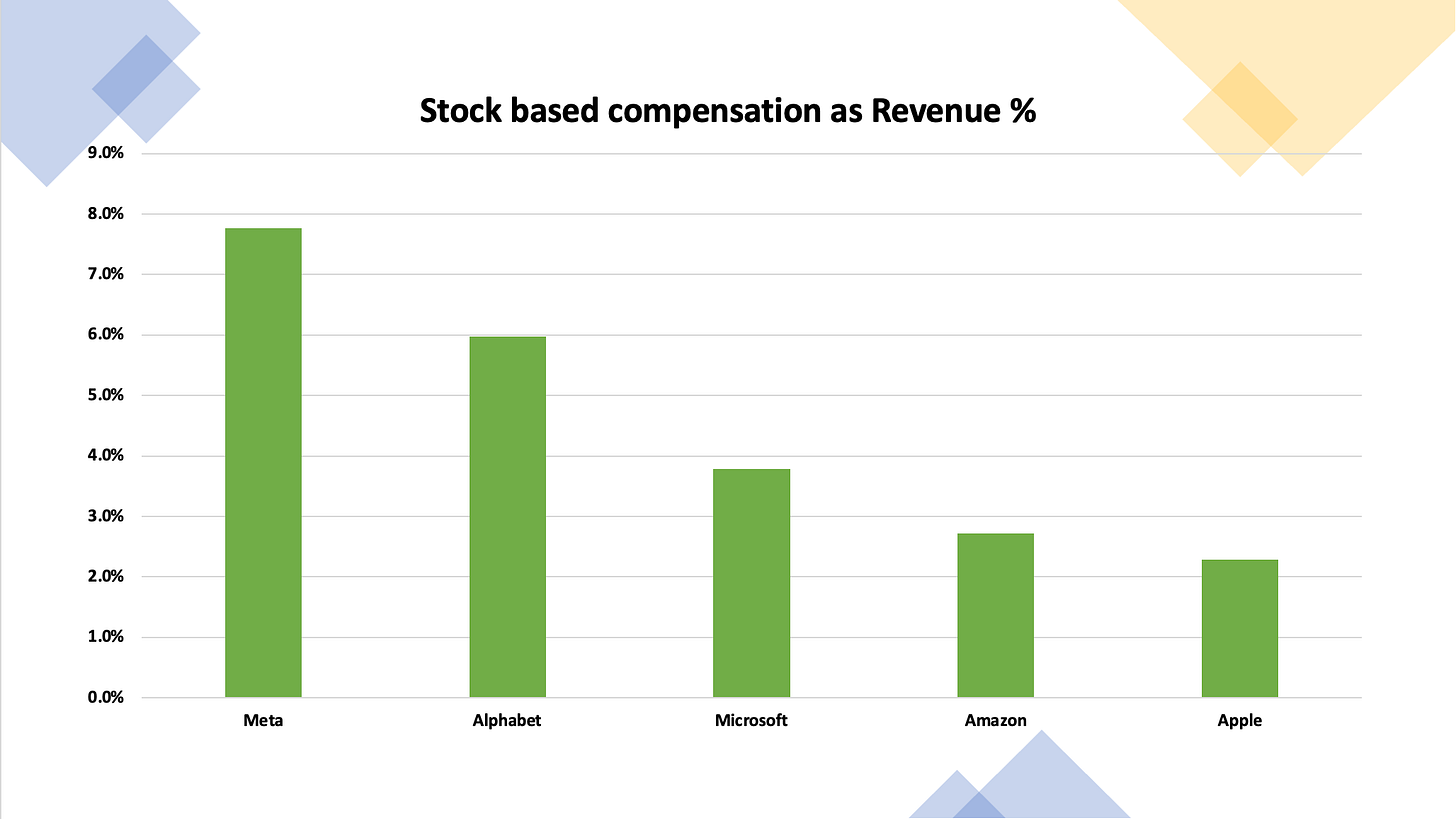

Why single out the SaaS? Doesn’t everyone do the same?

Not really.

The Big Tech (Meta, Alphabet, Amazon, Apple, and Microsoft), are quite conservative when it comes to stock-based compensations. Unlike the SaaS firms paying 19.6% revenue as stock based comp, BigTech spent b/w 2-8% of revenue last year as SBCs. Since they have a better margin profile, the share of OCF paid as SBC is about 1/5th of what is paid by the SaaS firms (20% vs 104%).

*Source: SEC Filings. Data reported as of the latest annual report filed.

Is the system being gamed here?

I do not think so. SaaS companies are not doing this with the intent of boosting the margin profile.

Stock-based compensation started with the right intent of aligning the incentives of the employees with that of the firm - you win if the firm wins. However, a combination of factors led to the SaaS firms getting carried away with SBCs. The ever-growing race to hire the best, the race to match comps with the BigTech, and the Great resignation era in the last few led to never seen compensation spikes, most of it paid as SBC.

However, this industry-wide trend may mislead investors who are not fully informed. Traditionally, the SaaS (Software as a Service) companies were sold largely on vanilla metrics like their revenue multiple and growth rate. With the ongoing market correction, the focus slowly shifted to profitability metrics. Most SaaS companies now actively report cash flows and cash flow margins, showcasing the health of the business. But, let’s remember that blindly following the reported numbers is far from ideal. Expenses such as Stock based compensation have a significant impact on the margins, and they should be properly accounted for to form a view on the business profitability.

Loved this piece. One of the best on the topic. One Question, how do you think that early growth stage companies should put this ton use.

Super interesting! But wondering if this is a bad thing at all? ESOP expenses don't actually come from a company's cash flow, so that money's always going to be in the bank for future investments. It's just an accounting quirk that a company's net profits are affected because of it. If a company can manage to increase cash flow, even if it compromises on net profits, wouldn't that be a good thing?